The Most Common Online Scams and Fraud Schemes Consumers Face Today

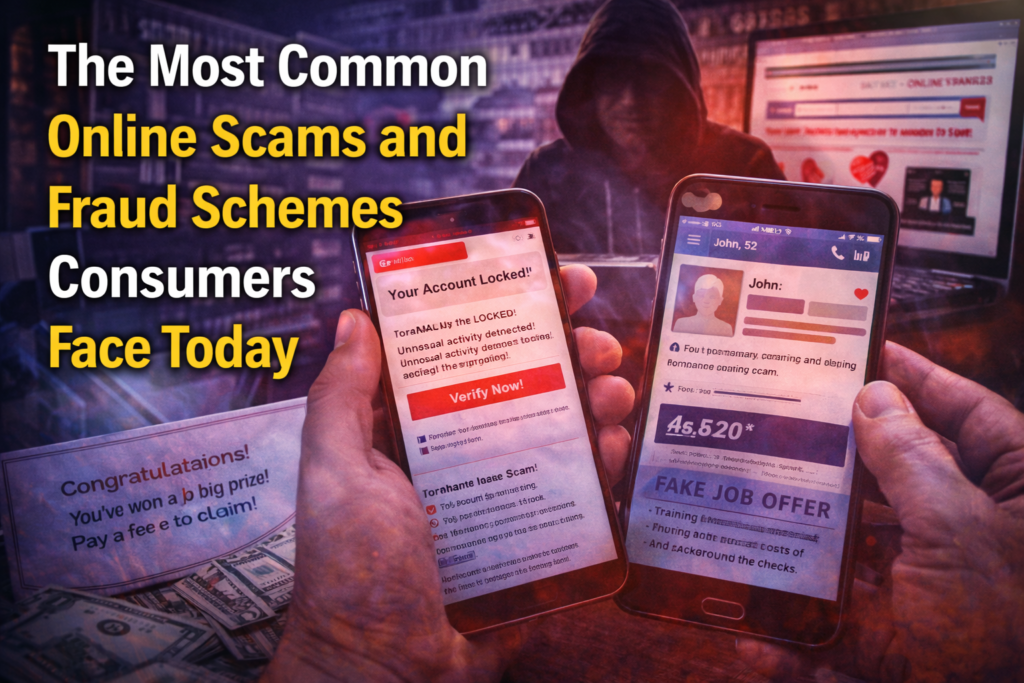

Online scams and digital fraud continue to evolve, targeting consumers of all ages and backgrounds. With more daily activities happening online — from shopping and banking to job searches and social networking — scammers are finding new ways to exploit trust, urgency, and lack of awareness. Understanding the most common scam types is the first step toward protecting yourself, your identity, and your finances.

Below is a breakdown of the most widespread online scams affecting consumers today and how they typically operate.

Phishing Scams

Phishing remains one of the most common and effective scam techniques. Fraudsters send emails, text messages, or social media messages that appear to come from trusted organizations such as banks, credit card companies, streaming services, or government agencies. These messages often warn of account issues, security breaches, or urgent actions needed.

Victims are directed to fake websites designed to look legitimate, where they are asked to enter login credentials, Social Security numbers, or credit card details. Once submitted, scammers use that information for identity theft or financial fraud.

Online Shopping Scams

Online shopping scams surge during holidays, major sales events, and times of economic hardship. Scammers create fake e-commerce websites or post fraudulent listings on legitimate marketplaces, advertising highly discounted products that seem too good to be true.

After payment is made, the product either never arrives, arrives as a counterfeit item, or is drastically different from what was advertised. In many cases, customer support disappears once payment is processed.

Tech Support Scams

Tech support scams typically involve scammers pretending to represent well-known technology companies. Victims may receive phone calls, pop-up warnings, or emails claiming their computer or smartphone has been infected with malware.

The scammer pressures the victim into granting remote access to their device or paying for unnecessary “repairs.” In reality, this access is used to steal data, install malware, or demand additional payments.

Investment and Cryptocurrency Scams

Promises of high returns with little or no risk are red flags of investment scams. Fraudsters promote fake opportunities involving stocks, cryptocurrency, real estate, or exclusive financial programs.

Common variations include Ponzi schemes, fake trading platforms, and pump-and-dump scams. Victims are often pressured to invest quickly and discouraged from withdrawing funds until it is too late.

Romance Scams

Romance scams thrive on emotional manipulation. Scammers create fake profiles on dating apps and social media platforms, slowly building trust and forming emotional bonds with victims.

Once a relationship appears established, the scammer fabricates emergencies, business problems, or travel issues and requests money. These scams can last months and result in significant financial and emotional loss.

Lottery and Prize Scams

In lottery and prize scams, consumers are told they have won a contest, giveaway, or sweepstakes they may not even remember entering. Victims are instructed to pay taxes, fees, or processing charges before receiving their winnings.

Legitimate lotteries and prizes do not require upfront payments to claim winnings, making this one of the easiest scams to spot — yet still widely successful.

Impersonation Scams

Impersonation scams involve criminals pretending to be someone the victim trusts, such as a family member, friend, employer, bank representative, or government official. These scams are often carried out via phone calls, emails, or hacked social media accounts.

Scammers create urgency or panic, asking for money, gift cards, or sensitive information. The emotional pressure makes victims more likely to act without verifying the request.

Charity Scams

Charity scams exploit generosity, especially during natural disasters, global crises, or major news events. Fraudsters claim to represent well-known or fake charities and request donations through email, social media, or crowdfunding platforms.

Often, these fake charities lack ver shows or digital footprints, and the donated funds go directly into scammers’ pockets instead of helping those in need.

Identity Theft Scams

Identity theft occurs when scammers collect personal information through phishing, data breaches, or malicious websites. This stolen information is used to open credit accounts, file fraudulent tax returns, or access bank funds in the victim’s name.

Victims often discover identity theft long after it occurs, making recovery more difficult.

Fake Job Offers

Fake job scams target job seekers through employment websites, emails, and social media messages. Scammers advertise attractive remote jobs or high-paying positions with minimal qualifications.

Applicants may be reminded to provide personal information, pay for training materials, background checks, or equipment. In some cases, scammers send fake checks and ask victims to send money back before the check bounces.

Bait-and-Switch Scams

In bait-and-switch scams, consumers are drawn in with extremely low prices or free offers, only to discover hidden fees, different products, or much higher costs after committing to the purchase.

These scams are common in online services, subscriptions, and travel bookings.

Ransomware Attacks

Ransomware attacks involve malicious software that locks a victim’s computer files and demands payment to restore access. These attacks often originate from phishing emails, infected downloads, or compromised websites.

Paying the ransom does not guarantee that files will be recovered, making prevention and data backups critical.

How to Protect Yourself from Online Scams

- Be cautious of unexpected emails, texts, or phone calls requesting personal information

- Avoid clicking links or downloading attachments from unknown or suspicious sources

- Use strong, unique passwords and enable two-factor authentication on all accounts

- Verify deals, charities, and businesses through official websites and reviews

- Monitor bank and credit accounts regularly for unusual activity

Staying informed and alert is the strongest defense against online scams and fraud. As scammers refine their techniques, consumer awareness remains the most powerful tool in preventing financial loss and identity theft.